Corporate Transparency Register

By: Gillian Thiel, Law Student

1. General Overview

Effective October 1, 2020, all British Columbia private companies incorporated (or transitioned) pursuant to the BC Business Corporations Act (the “Act”) will be required to create and maintain a transparency register. This new requirement is part of a comprehensive scheme being implemented by the Province of British Columbia to address the misuse of corporations for criminal purposes such as money laundering and tax evasion. Similar requirements have been implemented for companies incorporated under the Canadian Business Corporations Act and in jurisdictions around the world.

Only private companies incorporated under the BC Business Corporations Act will be required to create and maintain a transparency register in their corporate minute book. Public companies and extra-provincial companies are exempt from the transparency requirements in BC. The following entities are also exempt:

- Companies that are wholly owned subsidiaries of public companies;

- Trust companies;

- Insurance companies;

- Government corporations;

- Companies incorporated or wholly owned by a municipality or regional district;

- Companies that operate an independent school in British Columbia;

- Companies converted under the School Act; and

- Companies that are wholly owned by one or more Indigenous Nations.

2. Significant Individuals

The significant individual is the defining unit of the transparency registry. At its core, the transparency registry serves to drill down and identify all individuals who have the capacity to influence the company’s operations, through direct or indirect control and through registered or beneficial interests.

Under the Act, an individual is a significant individual if they have:

(a) an interest in 25 % or more of the issued shares in the company;

(b) an interest in issued shares of the company that carry 25% or more of the voting rights at general meetings; or

(c) the rights or ability to elect, appoint or remove a majority of the directors of the company.

The transparency requirements will apply to an individual who holds the interests described in (a) and (b) as either a registered owner or beneficial owner.

The requirements also apply to individuals who have indirect control over an interest described in (a), (b), or (c). An individual has indirect control if they control an intermediary who has one of the interests described in (a), (b), or (c). Control means they have the legal authority to direct the intermediary on how to exercise their rights in the company.

Intermediaries could be other companies, trustees, partnerships, agents, or personal or other legal representatives.

If one of the interests listed in (a), (b), or (c) is held jointly by two or more individuals, each of those individuals must be listed as a significant individual. Additionally, where the interests of two or more individuals, when combined, would satisfy the criteria for significant individuals and these individuals are “associates” who are party to an agreement to exercise their interests jointly or in concert, each of the individuals will be considered significant under the Act. The term “associate” is defined in s 192(1) of the Act and includes partnerships, trusts, and familial relationships.

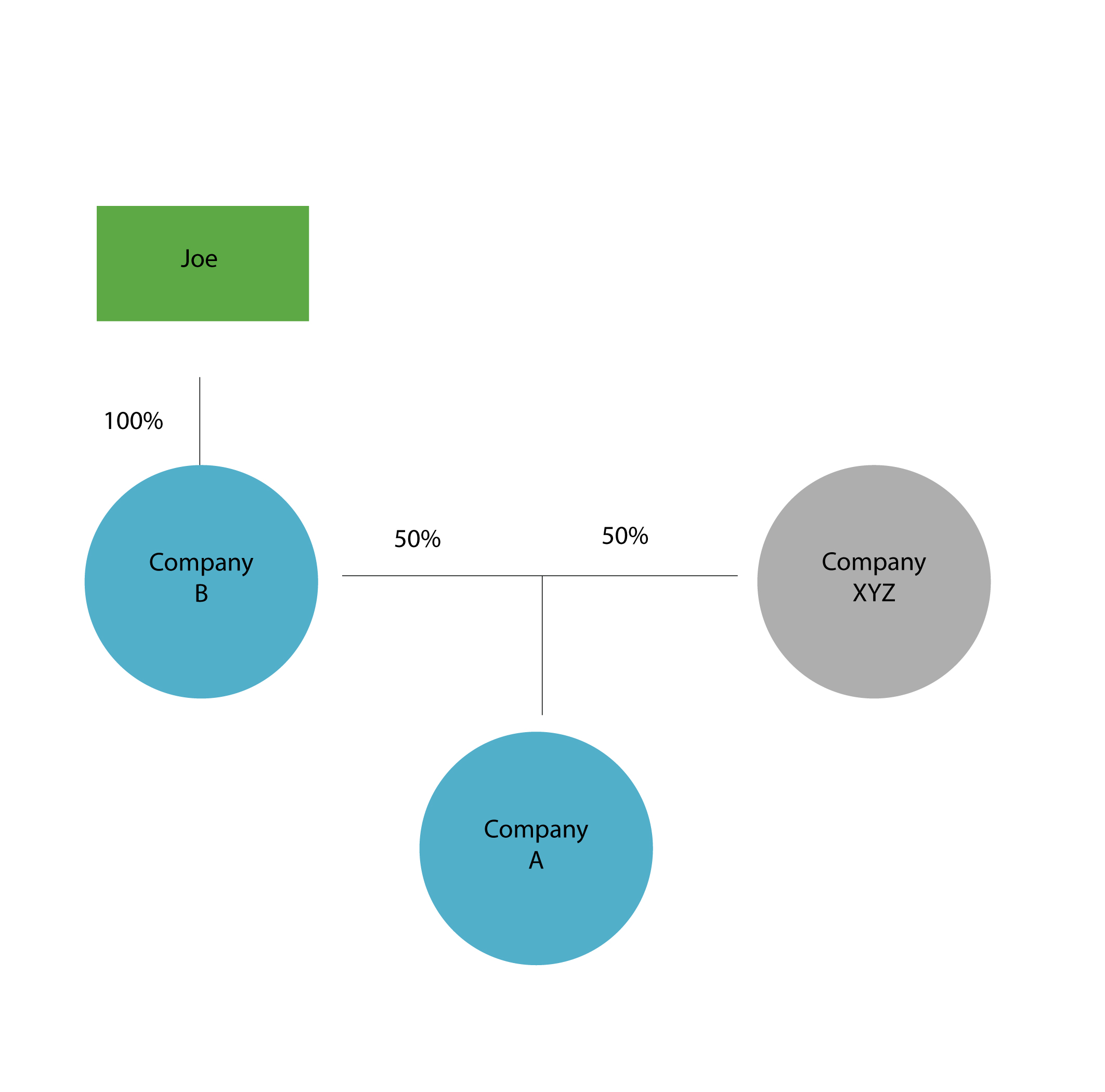

Example

By way of example, Company A is preparing its transparency registry filing. Joe owns 100% of the shares in Company B. Company B is a holding company which holds 50% of the shares in Company A. In this case, Company B is an intermediary controlled by Joe. Since Company B holds more than 25% of the shares in Company A, Joe indirectly controls more than 25% of the shares in Company A through the intermediary Company B. In this case, Joe is a significant individual of both Company A and Company B.

3. Information Required

For every significant individual, companies will be required to record their full name, date of birth, last known address, citizenship or permanent residency, the date they became a significant individual, the date they ceased to be a significant individual (if applicable), and why they are considered a significant individual. Examples of transparency registries provided by the Government of British Columbia can be found here.

4. Who will have access to your information

The public will not have access to the transparency register. The transparency register will be filed as a section in the company minute book and information contained within it will only be accessible to current company directors, law enforcement, tax authorities, and regulators such as the BC Securities Commission and the Law Society of BC.

5. Penalties for non-compliance

It is an offence to knowingly misidentify a significant individual, exclude a significant individual from the registry, submit false information about a significant individual, or omit information about a significant individual which makes the remaining information false or misleading. Any director or officer who permits or acquiesces to any of the offences above is also liable for the offence. The penalty for the above offences is a maximum fine of $100,000 for persons other than an individual, and a maximum fine of $50,000 for an individual.

6. What to expect from Stirling LLP

If you are currently a client of Stirling LLP, you will receive a reminder of your transparency register filing requirements from our office. Stirling LLP is also available to assist new clients in identifying significant individuals, creating the transparency registers, and updating company minute books. Please contact Roshni Reddy rreddy@stirlingllp.com for further inquiry.